Proven Tactics for Smart (Digital) Business Acquisitions — Guide

Source: unsplash

Strategic acquisitions have become an integral part of growth for companies. Whether they are looking to expand their market share or diversify their offerings, acquiring new assets is a wise move.

Digital mergers and acquisitions, in particular, have emerged as powerful strategies to drive growth, innovation, and market expansion.

The dynamic world of digital M&A sheds light on how companies can harness the potential of technology-driven partnerships. From identifying strategic targets to navigating integration challenges, this discussion delves into the intricacies and opportunities that await businesses in the digital era.

Discover how digital business acquisitions are reshaping industries and propelling companies toward a competitive advantage in the global marketplace.

Understanding the Importance of Digital Business Acquisitions

Smart digital acquisitions involve identifying and acquiring companies with complementary digital assets, technologies, or market access. This approach allows businesses to expand their product offerings, strengthen their competitive position, and drive innovation.

According to a PwC survey, about 52% of executives consider acquisitions as a primary strategy for accessing new talent, technologies, and markets.

Embracing the Digital Shift

With the rise of the internet and the digital era, traditional brick-and-mortar businesses are facing intense competition from online ventures. Embracing the digital shift through digital business acquisitions enables companies to tap into new customer bases. It’s also an excellent way to leverage innovative technologies and optimize business operations for the digital age.

Expanding Market Reach

Acquiring digital businesses allows companies to instantly expand their market reach without starting from scratch. This strategy helps in reaching a wider audience and gaining access to new geographical markets.

Accelerating Growth and Innovation

Digital businesses often possess innovative products, technologies, or processes that can fuel the acquiring company’s growth. By integrating these innovations, businesses can stay ahead of the curve and drive continuous improvement.

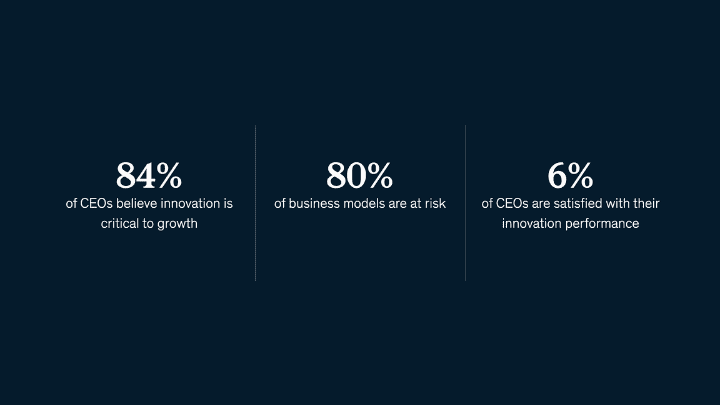

“Supporting companies’ growth transformations by helping them answer ‘when, where and how’ while setting aspirations to embed longstanding changes. Innovation is critical to growth, particularly as the speed of business cycles continues to increase. Most companies understand the importance of innovation but fall short when it comes to execution.”

Source: Mckinsey

Achieving Synergies

One of the primary reasons for acquisitions is to achieve synergies. This way, the combined entity’s value is greater than the sum of its parts. In digital acquisitions, synergies can be realized through shared resources, streamlined processes, and complementary skill sets.

In the context of digital business acquisitions, achieving synergies involves leveraging shared resources, streamlining processes, and tapping into complementary skill sets. Let’s delve deeper into each aspect:

- Shared Resources: When two businesses come together through an acquisition, they often possess overlapping resources that can be optimized for maximum efficiency. This can include technology infrastructure, data assets, intellectual property, and even customer databases. By consolidating these shared resources, the combined entity can eliminate redundancies, reduce costs, and better allocate assets to drive growth.

- Streamlined Processes: Digital acquisitions offer the chance to reevaluate and improve existing processes across both companies. By identifying and implementing best practices from each organization, the newly formed entity can streamline operations, reduce operational bottlenecks, and enhance productivity. Moreover, the integration of digital tools and technologies can lead to process automation, further optimizing workflows.

- Complementary Skill Sets: In the dynamic digital landscape, different businesses often possess unique sets of skills and expertise. Through acquisitions, companies can gain access to specialized talents and knowledge that may not have been readily available to them before. Integrating these complementary skill sets can enhance the overall capabilities of the company and foster a culture of innovation and collaboration.

It is important to note that achieving synergies in digital acquisitions requires meticulous planning and effective execution. The process involves aligning business objectives, harmonizing corporate cultures, and fostering open communication between teams.

Additionally, maintaining a clear focus on the overarching strategic goals of the acquisition is crucial to realizing the full potential of synergies.

Source: unsplash

Key Steps in Successful Digital Business Acquisitions

Identifying the Right Targets

The first step in a successful digital acquisition strategy is identifying the right targets. Companies need to conduct thorough market research and due diligence to find businesses that align with their long-term objectives. If you want to guarantee success, you can receive mergers and acquisitions support.

Valuation and Negotiation

Valuing a digital business accurately is crucial to ensure a fair deal. Various factors, such as revenue, profitability, growth potential, and market share, must be carefully evaluated. Skilled negotiation is essential to strike a win-win deal for both parties.

Integration Planning

Before finalizing the acquisition, a well-thought-out integration plan is necessary. This plan should outline how the two entities will come together, including merging teams, processes, technologies, and cultures.

Source: unsplash

Cultural Alignment

In digital acquisitions, cultural alignment is often overlooked but plays a critical role in the success of the integration process. Ensuring that both companies share similar values and work ethics fosters a smoother transition.

Post-Acquisition Integration

The work doesn’t end with the completion of the acquisition. Post-acquisition integration is a complex phase that requires careful execution. Companies need to address any challenges that arise promptly and monitor progress closely.

Mitigating Risks

Acquisitions come with inherent risks, especially in the digital realm, where technology and consumer behavior are constantly changing. Businesses must have a risk mitigation plan in place to handle unforeseen circumstances.

Buying Websites

Another effective tactic in smart digital business acquisitions is the strategic purchase of existing websites that align with the acquirer’s business goals. Acquiring established websites can provide instant access to an established customer base, valuable traffic, and well-developed online assets.

Moreover, it allows the acquiring company to skip the time-consuming process of building a website from scratch. Thanks to it, the organization can immediately capitalize on the acquired site’s existing SEO rankings and domain authority.

However, careful evaluation, meticulous planning, and a focus on seamless integration are paramount to the success of this tactic.

With the right approach, buying websites can prove to be a lucrative investment. It can offer immediate access to valuable digital assets and drive sustained growth for the acquiring company. Learn more on how to buy websites on BOB.

3 Case Studies of Successful Digital Business Acquisitions

Strategic acquisitions have emerged as powerful tools for fostering growth, innovation, and diversification. The success stories highlighted in these case studies exemplify the importance of aligning strengths, harnessing synergies, and capitalizing on emerging market trends to drive acquisition success.

Amazon: A Tale of Massive Growth

Source: unsplash

Amazon’s strategic digital acquisition catapulted them to the top of their industry.

Over the years, Amazon has strategically acquired numerous companies that have played a crucial role in expanding their business offerings. These acquisitions also helped the company enhance customer experiences and solidify its position as a global e-commerce and technology giant.

Some of the notable acquisitions include Zappos, Twitch, Whole Foods Market, and Pillpack. Amazon shows no signs of slowing with their latest $3.9 billion acquisition of the healthcare provider, One Medical.

Grab: From Local to Global

Grab, which was launched in Malaysia in 2012, acquired and merged with various companies to expand its service offerings and market presence. Its acquisitions include those of Southeast Asian Uber’s assets, drivers, and customer base in Singapore, Malaysia, Indonesia, Thailand, and the Philippines in 2018.

These business decisions solidified its position as the dominant ride-hailing service provider in the region.

Source: unsplash

Grab also acquired the fintech startup, Kudo, which allowed the company to enter the digital payment space. By leveraging Kudo’s technology and expertise, Grab expanded its services to include digital payments and financial solutions for its users.

Facebook (Meta Platforms Inc.): Dominating the Digital Landscape

Facebook’s strategic acquisitions of key digital assets played a pivotal role in its journey to dominance as a tech giant. By acquiring Instagram, WhatsApp, Oculus VR, and other innovative startups, Facebook expanded its user base and diversified its services.

Moreover, each acquisition brought new monetization opportunities for Facebook. It allowed the company to explore different revenue streams and strengthen its financial performance.

The Bottom Line

Smart digital business acquisitions can be a game-changer for companies looking to stay competitive and achieve exponential growth. The process involves meticulous planning, strategic thinking, and seamless execution.

By understanding the importance of digital acquisitions, following key steps, and mitigating risks, businesses can unlock new opportunities and drive sustainable success in the digital age.

FAQs

Q1: Are digital acquisitions suitable for all businesses?

Digital acquisitions can benefit various businesses, but it depends on their growth strategy, financial capabilities, and market positioning. Not all businesses may find it suitable, and a careful evaluation is necessary.

Q2: How long does the acquisition process usually take?

The timeline for an acquisition can vary significantly depending on factors like the size of the deal, regulatory approvals, due diligence, and integration complexity. It can take anywhere from a few months to a year or more.

Q3: What are some common challenges in digital acquisitions?

Common challenges include cultural clashes, technology integration issues, market changes, and the departure of key talent. These challenges need to be addressed proactively for successful integration.

Q4: Can digital acquisitions backfire?

Yes, digital acquisitions can backfire if not handled correctly. Without proper due diligence and integration planning, companies risk overpaying, facing operational disruptions, and losing the intended benefits of the acquisition.

Q5: How do I assess the potential of a target digital business?

Assess the target’s financial health, market position, customer base, growth potential, and alignment with your business goals. Engage with industry experts and conduct thorough research to make an informed decision.

Subscribe to our newsletter